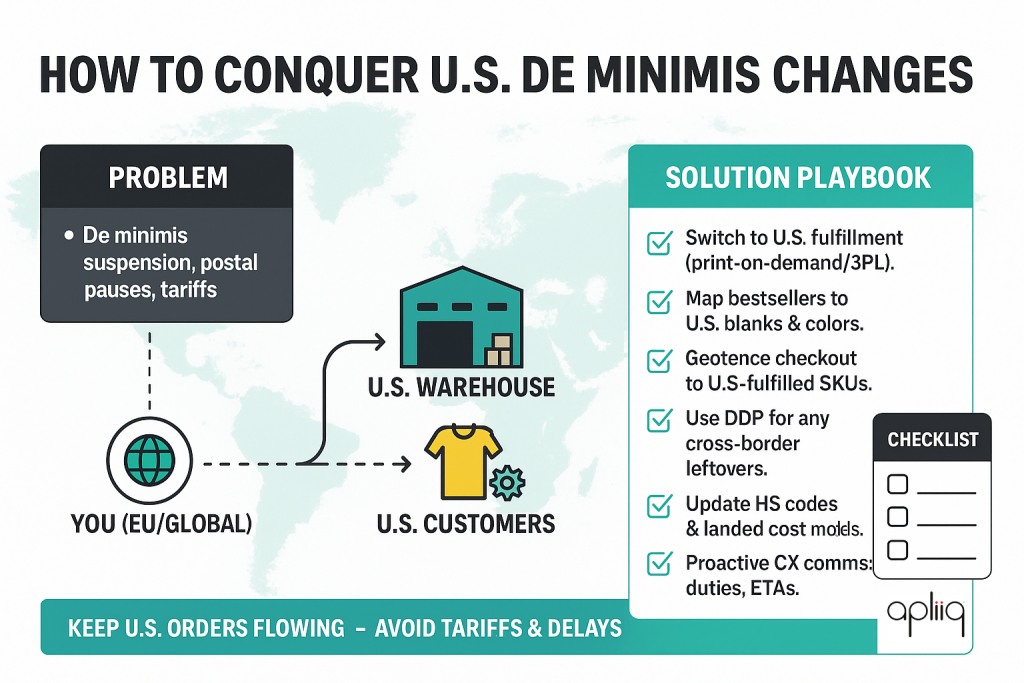

Effective August 29, 2025, the United States is ending duty-free “de minimis” treatment for low-value imports (≤$800). All postal parcels will be subject to duties, either via a temporary flat fee of $80–$200 per item (through Feb 28, 2026) or an ad-valorem levy thereafter. That shift has already triggered widespread pauses of U.S.-bound parcels by national postal operators, with 30+ countries halting or restricting service while they retool systems and data flows for the new rules. ( U.S. Customs and Border Protection & The Washington Post )

For fashion brands that sell into the U.S., this is not a drill: expect sudden checkout friction, delivery delays, and unexpected landed-cost increases on cross-border orders. While these changes will be undoubtably confusing and frustrating for brands that need to ship into the US, there are solutions to these challenges. The fastest path to stability is to fulfill inside the U.S.—ideally via a U.S.-based print-on-demand and 3PL partner—so you can avoid import tariffs and keep standard delivery times.

What changed (in plain English)

- The $800 de minimis window is suspended for all countries as of Aug 29, 2025. U.S. Customs and Border Protection

- Postal parcels now incur either (a) a temporary flat duty ($80–$200) per item based on country-of-origin tariff bands (through Feb 28, 2026), or (b) ad valorem tariffs thereafter. U.S. Customs and Border ProtectionThe Washington Post

- Postal carriers shipping into the U.S. must meet new bond, data, and entry requirements—hence many have paused U.S.-bound merchandise until compliant processes go live. U.S. Customs and Border Protection

Scale of impact: about 1.3–1.4B shipments a year previously used de minimis. That firehose is what’s been disrupted. The Washington Post

What stays the same

If you are already making and shipping products right here in the United States, you have nothing to worry about. The updates to de minimis rules will not directly affect your orders or your customers.

Countries pausing U.S.-bound postal parcels (rolling list)

Europe (including UK & EEA):

- Austria (Österreichische Post). post.at

- Belgium (bpost). press.bpost.be

- Croatia (Hrvatska pošta). posta.hrHrvatska radiotelevizija

- Czech Republic (Česká pošta). ct24.ceskatelevize.cz

- Denmark (PostNord; also covers Puerto Rico) — see PostNord group notice. group.postnord.com

- Estonia (Omniva). OMNIVA

- Finland (Posti). Posti

- France (La Poste; exceptions for personal gifts under ~$100 and Chronopost). aide.laposte.fr

- Germany (Deutsche Post/DHL—business parcels paused). DHL Group

- Italy (Poste Italiane). Sky TG24

- Latvia (Latvijas Pasts / Omniva network). eng.lsm.lv

- Lithuania (Omniva LT). OMNIVA

- Netherlands (PostNL). evofenedex.nl

- Norway (Posten/Bring). Posten.no

- Poland (Poczta Polska). Poczta Polska

- Portugal (CTT). CTT

- Slovenia (Pošta Slovenije). posta.si

- Spain (Correos; low-value parcels paused). correos.com

- Sweden (PostNord). group.postnord.com

- Switzerland (Swiss Post). Reuters

- United Kingdom (Royal Mail—temporary suspension of some parcel services to the U.S.). Yahoo News

- Hungary (Magyar Posta). Magyar Posta Zrt.

- Czechia (additional coverage/press). e15.cz

Asia–Pacific:

- Australia (Australia Post—partial suspension/limited services).

- Japan (Japan Post).

- South Korea (Korea Post; widespread press reports). DHL Group

- Singapore (SingPost—service announcements & FAQ). shop.singpost.com

- New Zealand (NZ Post). shipsmart.global

- India (India Post; government & trade press). Devdiscourse

Americas:

- Mexico (Correos de México). ABC News

Note: Some operators maintain exceptions (e.g., documents and personal gifts ≤$100), or continue via express subsidiaries while pausing standard post. Always check the latest carrier bulletin before booking. aide.laposte.fr

What this means for fashion brands outside the U.S.

- International DTC orders are at risk. Carriers are returning or refusing U.S. parcels containing commercial goods, and those accepted may face new duties at the border, creating surprise costs, holds, and delivery lag. The Washington Post

- Marketplace labels may be disabled. Some platforms have temporarily paused U.S. label purchases for affected carriers while they update flows. nationnews.com

- Your U.S. CX will suffer if you keep shipping cross-border during the transition—higher landed costs, checkout friction, and slower delivery times can tank conversion and LTV. The Washington Post

The mitigation playbook (start this week)

- Shift U.S. orders to U.S. fulfillment.

Route some or all U.S. demand to a stateside print-on-demand / 3PL to avoid import tariffs and normalize transit times. If you’re apparel, a partner like Apliiq (Los Angeles & Philadelphia facilities) can on-demand print, pack, and ship domestic—no cross-border customs, no surprise duties for your customers. - Stand up a U.S. catalog quickly.

- Sync your bestsellers in U.S. blanks and colors.

- Mirror EU designs with regionally suitable garment equivalents.

- Use domestic size curves and content to minimize returns.

- Enable Delivered Duty Paid (DDP) only for any residual cross-border shipments.

If you must send from abroad, work with a carrier or qualified filer that can pre-collect duties/taxes and submit compliant data to CBP. (CBP is allowing a 6-month flat-duty option to ease the transition.) U.S. Customs and Border Protection - Rebuild your checkout logic.

- Geofence U.S. visitors to U.S.-fulfilled SKUs.

- Hide, warn, or lengthen ETAs on cross-border methods.

- Show landed-cost clarity (or remove cross-border methods entirely for now).

- Update ops & finance.

- Refresh HS codes, COO tagging, and GTINs in your PIM/ERP.

- Model new landed costs; expect 10–50% duty equivalents by origin/tariff class, or the temporary $80–$200 per-item fees. The Washington PostU.S. Customs and Border Protection

- Brief CX: scripts for “why my parcel was returned/charged” and quick resolutions.

Quick FAQ

Does this hit express couriers too?

Express carriers are not “paused,” but every parcel still needs the right data and duty remittance. Some merchants will find express workable short-term; many will still prefer U.S.-side fulfillment to remove risk. FedEx

Any exemptions?

Certain donations/informational materials remain duty-free; several postal operators are still accepting documents and gifts ≤$100 between individuals. Not applicable to normal commercial orders. U.S. Customs and Border Protectionaide.laposte.fr

How long will postal pauses last?

Operators say temporary—but the new compliance/bonding and data changes are non-trivial. Planning for weeks of turbulence is prudent; fulfilling inside the U.S. sidesteps the issue entirely. The Guardian

Bottom line for Global & EU fashion brands

- Cross-border to the U.S. just became risky and more expensive, fast.

- Move U.S. demand to U.S. production/fulfillment now to avoid tariffs, uncertainty, and shipping delays.

- Keep a small, DDP-only cross-border lane if you must—but treat it as a backup, not your primary U.S. channel.